For freelancers, solo entrepreneurs, and small business owners, managing money is often one of the most time-consuming and confusing parts of the job. That’s where Kontist comes in—a financial platform built specifically for the self-employed, offering intuitive banking and tax tools that make managing business finances easier and more transparent.

Why Their Product Stands Out

Kontist isn’t just another digital bank. It’s a service tailored to the unique needs of freelancers and the self-employed in Germany. One of the most distinctive features is its real-time tax calculation. Every time money comes into your account, the platform automatically estimates your income tax and VAT obligations—no more guessing or last-minute panic before filing deadlines.

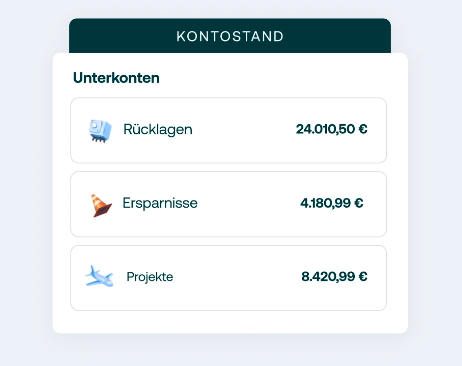

This tax automation alone makes Kontist a trusted financial companion. It separates taxes into dedicated sub-accounts, ensuring that what’s yours stays yours, and what’s owed is already set aside.

What You’ll Find on the Website

The Kontist website is structured to guide users through all the services available. You’ll find details about their business bank account, how the tax automation works, and the added benefits of their accounting services, which include integrations with DATEV and other major German tax platforms.

Visitors can also explore the Kontist Tax Service—an in-house digital tax consultancy that supports clients with annual returns, ongoing bookkeeping, and personalized guidance. This allows users to handle everything in one place, rather than juggling between banking apps, spreadsheets, and external tax advisors.

The site is rich in educational content too. From blog posts about freelance financial tips to frequently asked questions about business banking and taxes in Germany, Kontist offers clarity and transparency at every step.

How They’re Different from Other Brands

What makes Kontist different is that it doesn’t try to be a one-size-fits-all solution. It’s built from the ground up to serve the self-employed community. Traditional banks and even some neobanks offer business accounts, but they rarely cater to the unique tax, cash flow, and compliance challenges that freelancers face.

Unlike generic banking apps, Kontist understands that your income might be irregular, that taxes are a constant concern, and that simplicity is key. By automating the most stressful parts of money management, they remove barriers that typically prevent freelancers from thriving financially.

Their partnership with Solarisbank ensures users get the reliability and security of a licensed banking institution, combined with the agility of a tech-driven service. Plus, customer support is tailored—meaning that the team understands the language of freelancers and small business owners.

Flexible Banking with Full Control

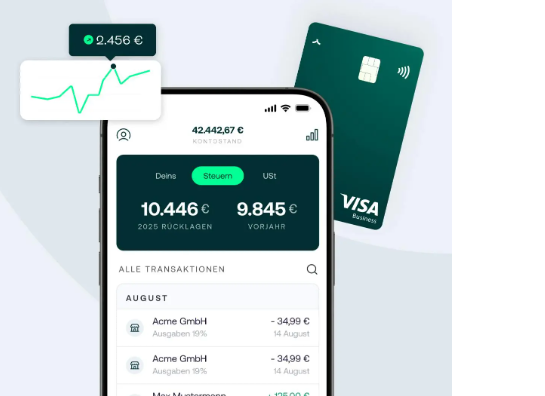

Another reason why Kontist has gained such a strong reputation is its simple, powerful banking app. Users can easily create invoices, categorize transactions, upload receipts, and monitor tax reserves in real time. Everything is designed to work seamlessly from your smartphone or desktop, giving users full control without the complexity.

Their Visa business card, push notifications, and recurring payment tools also make everyday operations easy to manage. Whether you’re getting paid by a client or buying business supplies, your transactions are sorted and analyzed on the fly.

A Dedicated Tax Service for Freelancers

Perhaps one of the biggest differentiators is the optional Kontist Tax Service. For freelancers who prefer not to handle taxes alone, the service provides access to certified tax professionals who handle monthly accounting, VAT filings, and even end-of-year returns.

By combining banking and tax into one ecosystem, Kontist removes the friction that many freelancers face when trying to manage finances. It’s not just a bank account—it’s a financial partner.

Designed for the German Market

Kontist focuses specifically on the needs of freelancers working in Germany. Everything, from compliance tools to tax logic, is aligned with local laws and expectations. This regional specialization allows them to offer more accurate support and relevant tools compared to international competitors.

Their deep understanding of German regulations means fewer errors, reduced audit risk, and greater peace of mind.

Conclusion

For freelancers and self-employed professionals in Germany, managing finances shouldn’t be a burden. Kontist offers a modern, intuitive solution that merges banking and tax into one efficient, easy-to-use platform. By automating tax calculations, simplifying account management, and offering personalized support, they empower users to focus on their work—not their paperwork.

If you’re ready to take control of your business finances without the stress, Kontist is worth considering as your financial partner.