A flexible approach to travel and hire-excess insurance

Gigasure offers a range of insurance products designed to address different travel and rental situations — from regular holidays to long backpacking trips, and from car hires to van rentals. Their categories include travel insurance (single-trip or annual), backpacker insurance, car-hire excess cover, and van-hire excess cover. This breadth means that whether you’re planning a short city break, a long adventure, or renting a vehicle, you’re covered with one provider.

Customisable policies tailored to your needs

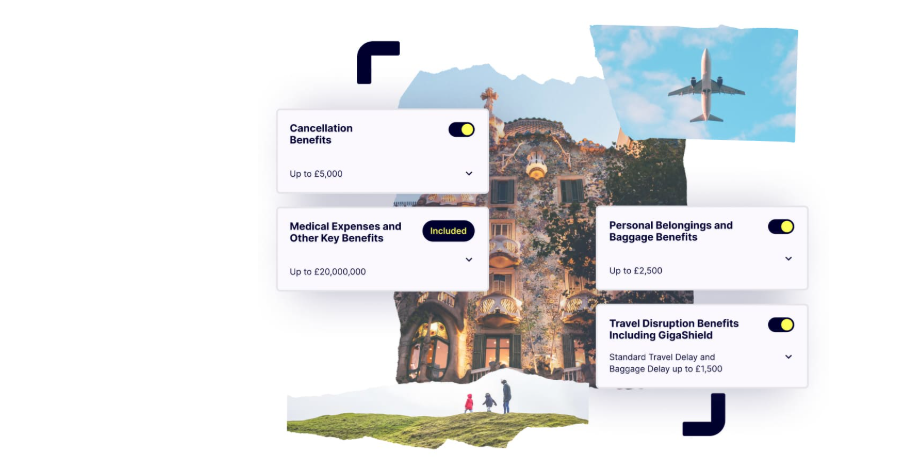

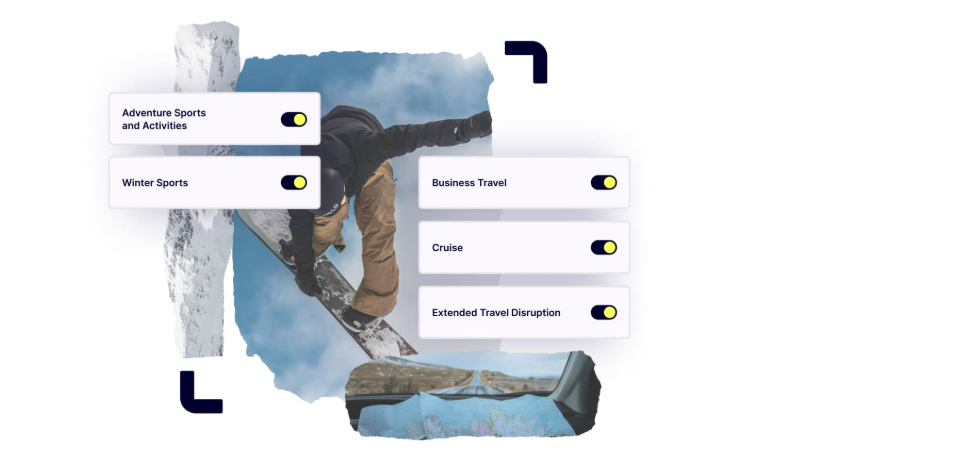

One of the key advantages of Gigasure is how flexible their offerings are. On their website you can build a base policy and then adjust it to match your needs: add or remove benefits, select coverage level, and include optional “boosts” for special needs like adventure-sports cover, cruise cover, or extended travel disruption. This allows you to pay only for what you need, rather than being forced into a one-size-fits-all plan.

Easy online process and supportive digital tools

The site (and connected app) makes purchasing and managing insurance relatively straightforward. You can get a quote, select your policy type, tailor the coverage, and complete payment — often within minutes. Once you’re covered you can manage your policy, activate optional benefits (like delayed flight or baggage delay cover), and submit claims directly through the app. For many travellers who value convenience, this streamlined digital experience is a major plus.

Special features for modern travellers

Gigasure includes some standout features that set it apart from more traditional insurers. One such feature is “GigaShield,” which offers extra protections like cash compensation or lounge access if your flight or baggage is delayed. For backpackers or frequent travellers, the ability to add post-purchase boosts — for example for adventure sports, cruise travel or other special activities — gives flexibility and peace of mind, adapting to changing plans rather than locking you into a fixed coverage model.

Why this brand differs from classic insurance providers

Unlike many insurers that offer rigid plans, Gigasure focuses on personalisation and flexibility. Their plans are modulable, easy to manage online, and designed for modern travel patterns — from short holidays to backpacking, from car hire to adventurous activities. Their extra features (like flight/baggage delay protection) and the ease of using an app — from policy setup to claims — make them more user-centric than traditional ones that might require lengthy paperwork or offer less transparent pricing.

Who benefits most from using Gigasure

- People travelling irregularly or spontaneously — who want the freedom to tailor cover per trip.

- Backpackers, adventure-seekers, and travellers with dynamic or changing plans — who need flexibility and add-on options.

- Anyone hiring a car or van for holiday or work — who wants excess cover without fuss.

- Travellers who prefer digital convenience — managing policy, claims and extras through an app rather than paperwork.

- Those seeking cost-effective but comprehensive cover — thanks to modular plans that avoid paying for unused benefits.

How Gigasure fits into the modern travel-insurance landscape

In a world where travel styles are diverse — short getaways, long backpacking, car rentals, adventure-sports vacations — Gigasure offers a refreshing alternative to cookie-cutter insurance. Their emphasis on customisation, digital tools, and flexible coverage turns insurance from a rigid necessity into a tailored service. For many travellers, this means better-fitting coverage, transparent pricing, and a simpler, more modern user experience — all in one place.